Home Loans

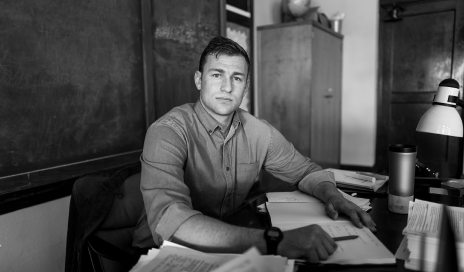

LET VETERANS AFFAIRS HELP YOU GET INTO YOUR OWN HOUSE

Guard members may be eligible for home loans from the Department of Veterans Affairs (VA) with little to no down payment. VA loans make buying a home more affordable and are available for home purchases and refinances. A VA loan eliminates the homebuyer’s need to make a down payment and purchase private mortgage insurance for homes up to $484,350.

VA-guaranteed loans are made by private lenders such as banks, savings, loans, or mortgage companies to eligible Veterans for the purchase of their home, which must be for occupancy. To obtain a loan, a Veteran must apply to a lender. If the loan is approved, the VA will guarantee a portion to the lender. This guarantee protects the lender against loss up to the amount guaranteed and allows a Veteran to obtain favorable financing terms. One weekend per month plus an additional 15 days per year, for 20 years.

Qualified Veterans need to obtain a certificate of eligibility from the VA, or your lender may be able to get one for you online. Members with six or more years of Guard service, or those with 90 days of continuous federal Active Duty service (Title 10), are eligible for the “VA Home Loan Insurance Program.” Explore your options online at HomeLoans.VA.gov.